- Get your free information package by contacting us:

- (416)-577-3504

- mail@vipgtacondos.ca

Call Us For More Info: 416-577-3504

5 Key Forces Impacting Toronto's Real Estate Market in 2018

The Toronto real estate market, the second largest housing market after Vancouver in Canada. In 2017 it saw some major drama with affordability dropping to record lows and residential sales declining by 18% from 113,000 residential transactions in 2016 to 92,394. The market is expected to remain calm in the first half of 2018 but TD bank economics project a recovery and healthy growth of 5% in the second half of 2018 and in 2019. Some changes that have strongly influenced the Toronto housing market are discussed below:

1. Implemented policy changes

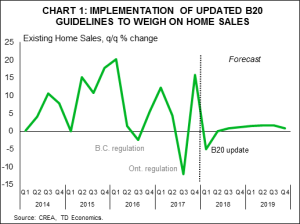

Over the last year, there have been multiple regulations changes at the federal, provincial and municipal levels. This includes the rise of a foreign home buyer’s tax of 15%, and the strict rules placed on short-term rental services such as Airbnb that were introduced to help regulate Toronto’s high housing prices and low vacancy rates as well as prevent vulnerabilities. These regulations are effective at taming the highly diverged Canadian housing market while reigning in high prices in the intended regions. The updated B20 guidelines (also known as the mortgage stress test) will impact but not upend sales activity in Toronto due to its stable economic conditions see.

2. The OSI’s Stress Test Rules

The governments' Office of the Superintendent of Financial Institutions (OSI) now requires homebuyers taking out mortgages to meet a “stress test” this has forced down house prices by around 2% on average especially in Toronto.

3. Rising rates in the housing market

The past few years have seen flat and declining interest rates. However, the Bank of Canada is now responding to the improving economic growth by increasing its benchmark overnight lending rate. 2017 saw a 50 basis point increase and another 25 basis point increase at the beginning of 2018. The higher the interest rates, the lower the number of people who can afford to buy homes.

2018 could be an excellent year for homebuyers to invest. However, while some factors may push prices upwards, others will likely push them back down. What this means is that, overall, the prices will not rise as fast as they have done in the past. The threat of higher interest rates and tighter mortgage lending rules will impact the buying activity in 2018.

Toronto home buyers have been known to stretch their budgets in an attempt to buy from the highest priced markets. However, the revised Stress Test rule will curb this behaviour. This test requires all borrowers to undergo an income test that is at an interest rate 2% higher than the 5-year scale mortgage rate issued by the Bank of Canada.

This means that buyers looking to borrow money from banks must prove their ability to afford the prime rate from the Bank of Canada. This test aims to ensure that borrowers can withstand higher rates. Essentially, this requires a higher income. This rule could reduce the purchasing ability of some homeowners by at least 15%, leading to a housing sales decline of about 5%.

See the article How to Understand the New Mortgage Stress Test? for an in-depth review of how the mortgage stress test will work.

On the positive side, house prices in Toronto are expected to increase in 2019 as the effects of B20 rules are fully absorbed by the market and the market adapts to higher interest rates.Average existing home prices are expected to enter a positive growth zone of 2.2% by the beginning of 2019 while existing home sales are predicted to rise by 1.1%, a departure from its lowest negative decline in 2017. Sales-to-new-listings ratio is also forecasted to rise by 2.2% in 2019.

Factors Pushing Housing Prices Up

Even though Toronto Housing Market will be down in the interim, there are some factors that may push housing prices up in the nearest future. These include:

1. Millennials: Millennials are getting to the home buying age in high numbers. This means that although some people may be disqualified from buying homes by factors like the Stress tests and rising bank rates, there are still many other buyers looking to invest.

2. Immigration: The number of immigrants in Canada is expected to grow up to 310,000 in 2018. An increase in the number of immigrants in Canada increases the demand for homes. This, in turn, may push prices up mainly in big cities like Toronto where immigrants are likely to settle.

In Conclusion: Going forward, the downward pressure on the Toronto real estate market will remain in the interim with the possibility of another round of tightening regulations being implemented which will dampen sales activity in Toronto and put plunging pressure on prices until demand rebalances. These negative pressures are expected to ease up in the future as the Toronto economy continues to grow leading to higher income and banks relaxing their lending rules.